Illustrative List of SAC Code – Chartered Accountants Office

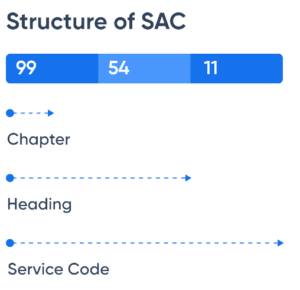

The Services Accounting Codes (SAC) system is a comprehensive classification system used in India for GST purposes. The SAC codes are intended to simplify the process of identifying and taxing different types of services. By correctly classifying their services, businesses can avoid mistakes that could result in increased GST and financial penalties. It is therefore imperative that businesses take the time to accurately classify the services they offer by using the corresponding code. SAC codes provide clarity and transparency, as it ensures consistency in the interpretation of services and their taxation across all businesses operating in India. So, organizations should utilize the SAC codes to ensure that their financial transactions are accurately recorded and taxed in accordance with the law.

SAC codes serve multiple purposes, including:

- They allocate unique codes to different services, thus enabling easy distinguishing.

- They help GST taxpayers identify the GST rate applicable to the services rendered by them.

- GST taxpayers are required to state these SAC codes when they register on the GST portal, on their invoices and in GST returns.

| Illustrative SAC classification of services as per Goods and Services Act, 2017 | ||

| Heading & Group | Service Code (Tariff) | Service Description |

| Heading no. 9982 | Legal and accounting services | |

| Group 99821 | Legal services | |

| 998212 | Legal advisory and representation services concerning other fields of law. | |

| Income Tax Appeals, Representations and Litigation Matters | ||

| VAT Appeals, Representations and Litigation Matters | ||

| GST Appeals, Representations and Litigation Matters | ||

| NCLT Appeals, Representations and Litigation Matters | ||

| Service Tax Appeals, Representations and Litigation Matters | ||

| Income Tax Opinion Services | ||

| GST Opinion Services | ||

| VAT Opinion Services | ||

| Company Law Opinion Services | ||

| Profession Tax Appeals, Representations and Litigation Matters | ||

| 998213 | Legal documentation and certification services concerning patents, copyrights and other intellectual property rights. | |

| 998214 | Legal documentation and certification services concerning other documents. | |

| Transfer Pricing Certificate in Form 3CEB under Income Tax Act 1961 | ||

| MAT Reports under Income Tax Act 1961 | ||

| Form 67 Filing under Income Tax Act 1961 | ||

| ROC Certificates under Companies Act 2013 | ||

| 998215 | Arbitration and conciliation services | |

| 998216 | Other legal services n.e.c. | |

| Group 99822 | Accounting, auditing and bookkeeping services | |

| 998221 | Financial auditing services | |

| Tax Audits | ||

| Bank Statutory Audits | ||

| Concurrent Bank Audits | ||

| Internal Audits | ||

| Revenue Audits | ||

| GST Audits | ||

| Stock Audits | ||

| LLP Audits | ||

| 998222 | Accounting and bookkeeping services | |

| Accounting and Book Keeping Services for Corporate and Non Corporates | ||

| Accounting MIS reporting anciliary to accounting and Book keeping services | ||

| 998223 | Payroll services | |

| Payroll Processing Services | ||

| HR Advisory Services | ||

| HR Manual and System Designing Services | ||

| 998224 | Other similar services n.e.c | |

| Statutory & Non Statutory Certification Services | ||

| Transactions Audits | ||

| Systems Review and Advisory Services | ||

| General Retainerships | ||

| Stock Inspections Visits | ||

| Fixed Assets Reviews, Verifications etc. | ||

| Group 99823 | Tax consultancy and preparation services | |

| 998231 | Corporate tax consulting and preparation services | |

| Corporate Tax consulting Services | ||

| Corporate Income Tax Returns Services | ||

| Corporate GST Returns Services – GSTR 1 GSTR 3B GSTR 3BQ GSTR 9 GSTR 10 , Other GST Forms etc | ||

| Corporate TDS Returns | ||

| Corporate Remittances Form – Form 15CA & Form 15CB | ||

| Corporate ROC Returns and advisory services under Companies Act 2013 | ||

| Note: above includes certifications also if needed | ||

| Heading & Group | Service Code (Tariff) | Service Description |

| 998232 | Individual tax preparation and planning services | |

| Individiual Income Tax Returns Preparation Services | ||

| Individual Income Tax Returns filing Services | ||

| Individual Taxation Planning Services | ||

| Non Corporate GST Returns Services – GSTR 1 GSTR 3B GSTR 3BQ GSTR 9 GSTR 10 , ITC 01/02/03 etc | ||

| Non Corporate TDS Returns | ||

| Individual Remittances Form – Form 15CA & Form 15CB | ||

| Note: above includes certifications also if needed | ||

| Group 99824 | Insolvency and receivership services | |

| 998240 | Insolvency and receivership services | |

| IBC Practice Insolvency and receivership services | ||

| Heading no. 9983 | Other professional, technical and business services | |

| Group 99831 | Management consulting and management services; information technology services. | |

| 998311 | Management consulting and management services including financial, strategic, human resources, marketing, operations and supply chain management. | |

| CFO Services | ||

| CISA and DISA Services | ||

| Group 99839 | Other professional, technical and business services. | |

| 998399 | Other professional, technical and business services n.e.c. | |

Note: All users are requested to verify the classifications before relying on the compilations of the above information and it has been compiled based on our understanding of the classifications. For detailed list of hsn and sac codes, please visit https://services.gst.gov.in/services/searchhsnsac

Though all efforts have been made to ensure the accuracy and currency of the above article, the same should not be construed as a statement of law or used for any legal purposes or any litigation as legal and binding advice from Team KabraVaibhav. Team KabraVaibhav hereby expressly disowns and repudiates any claims or liabilities (including but not limited to any third-party claim or liability, of any nature, whatsoever) in relation to the accuracy, completeness, and usefulness of any information available through this article, and against any intended purposes (of any kind whatsoever) by the use thereof, by the user (whether used by user(s) directly or indirectly).

THIS ARTICLE IS FOR INFORMATION PURPOSE ONLY