The direct tax payments facility hase been migrated from OLTAS ‘e-payment: Pay Taxes Online’ to the e-Pay Tax facility of the E-Filing portal. Users are advised to navigate to the ‘e-Pay Tax’ portal of the Income Tax Department at https://www.incometax.gov.in/ to make direct tax payments.

Online Tax Accounting System (OLTAS) payments and refunds

Online Tax Accounting System (OLTAS). Topics discussed here include:

- OLTAS Payments

- Payment online

- Payment made at banks

- OLTAS Refunds

- Refund Banker Scheme

- How to check refund status online?

- Key points to be noted in case of refund claim

- Procedure for the request for re-issue of refund

1. OLTAS Payments

OLTAS was introduced for the collection, reporting, and accounting of all kinds of direct taxes. We will discuss the below procedure for direct tax payments under OLTAS. You may do it online or offline by visiting any of the OLTAS authorized bank branches.

2. Payments online

- Visit https://www.tin-nsdl.com/ > Services > e-payment : Pay Taxes Online

- Choose the relevant challan for the payment:

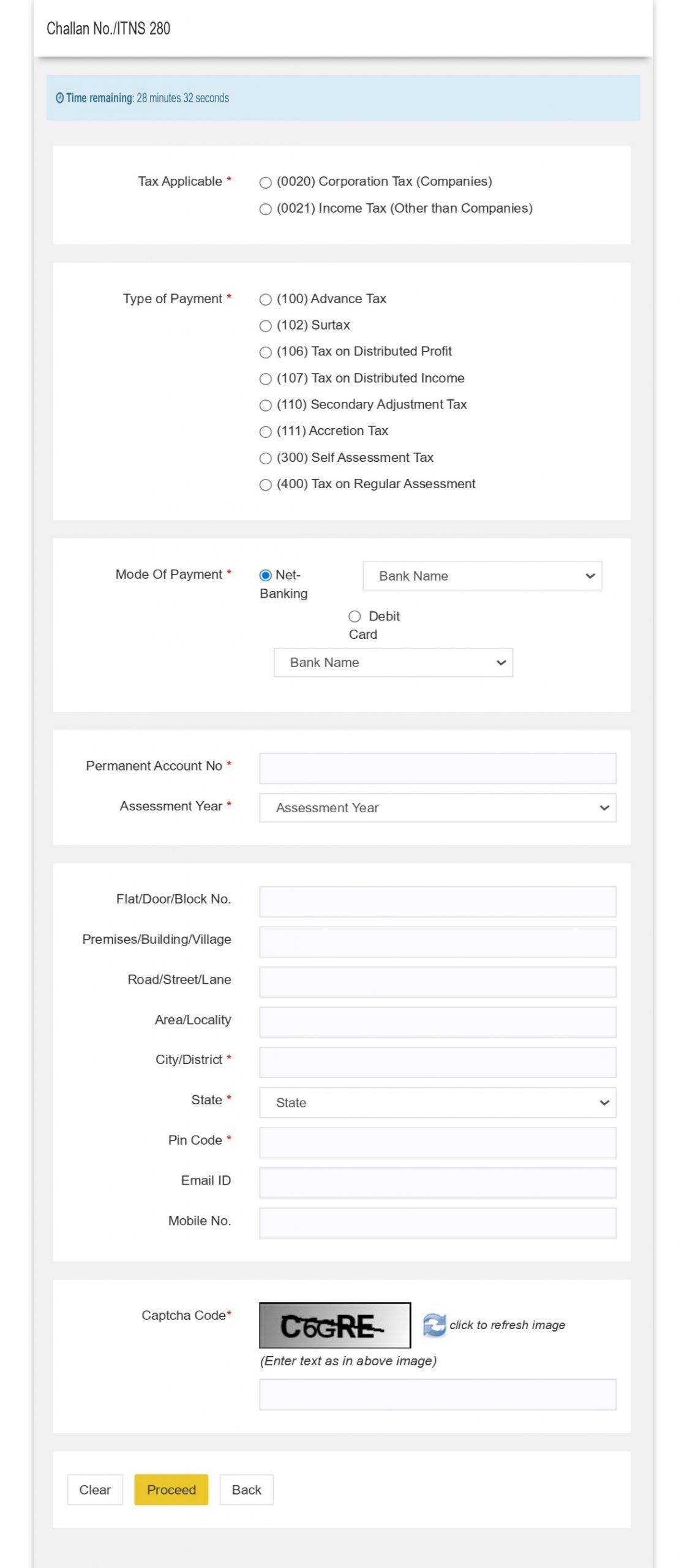

- For ease of explanation, we are using screenshots of Challan No./ITNS 280. The procedure is similar for all types of challan

- Select applicable major head code i.e., corporate tax or non-corporate tax under taxes applicable

- Enter PAN and Assessment year for which tax is being paid. No need to enter the name of the taxpayer. Data with respect to the name will be automatically taken from PAN records and displayed on the next screen.

- Enter contact details such as an address, email id, and contact number

- Select applicable minor head code

- Select mode of payment whether net banking or by using a debit card and choose the bank name from the drop-down. As of now, debit card payment is enabled only for four banks namely HDFC, ICIC, Indian Bank, Punjab National, and State Bank of India. Netbanking payment is available for 25 banks. Also, enter captcha image and click on ‘Proceed’

- Once you submit the data, a confirmation screen will be displayed along with that taxpayer’s details as per PAN.

- Post verification, click on ‘Submit to the bank. In case details need to be modified click on ‘edit’ and follow the same procedure again.

- The taxpayer will now be directed to the bank website. Either login to net banking or enter debit card details and complete the payment

- On successful payment processing, a challan counterfoil will be displayed containing Challan Identification Number (CIN), payment details, and bank name through which e-payment has been made. This serves as proof of tax payment. CIN is a unique number containing the following information:

a. 7 digits BSR Code allotted by RBI to the bank branch where tax is deposited

b. Date of presentation of the challan (DD/MM/YY)

c. 5 digits serial number of Challan in that bank branch on that day

3. Payment made at banks

- You can make payment at any bank, authorized under OLTAS. Bank branch details can be found here

- Payment can be made either by way of cash or cheque or Demand Draft

- Fill the challan as mentioned in ‘online payment’ and submit it to the bank

- The tear-off portion from the challan is given to taxpayers after the collecting bank puts a rubber stamp on the challan and its counterfoil with a unique Challan Identification Number (CIN).

- The tear-off portion of counterfoil is given to the taxpayer immediately in case of cash payment and after realization of demand draft or cheque in case of payments by DD/cheque. However, in the case of online payment, a challan is generated immediately after payment processing. However, the tax payment date will be the date of submission of the cheque or demand draft.

4. OLTAS Refunds

Once income tax returns are filed by taxpayers, they are processed by the income tax authorities at the Centralised Processing Centre (CPC) for arithmetical accuracy and matching the tax paid/deducted details entered in the return with details available in income tax department records. Post return processing, an intimation will be sent to the taxpayer intimating the tax payable/refund. In case of refund payable to the taxpayer, the refund orders are generated and transmitted to the income tax refund banker—State Bank of India, CMP branch, Mumbai as per refund banker scheme.

5. Refund Banker Scheme

Launched in 2007 by the finance minister to speed up the refund issue process, the refund banker scheme authorizes specific banks to issue refunds on behalf of the income tax department. State Bank of India is the authorized banker under the scheme. Once returns are processed, refunds are transmitted to SBI on the next day of processing. Either a cheque is sent to the communication address available in the income tax return or credited directly to the bank account of the taxpayer via ECS.

The refund banker scheme is available for all kinds of taxpayers (except large taxpayer units) and for returns processed at CPC/by the tax officer. OLTAS has enabled taxpayers to check the status of refunds online after 10 days of their refund being transmitted to SBI.

6.How to check refund status online?

The introduction of OLTAS has made checking refund status easy and it can be checked online by using the below procedure:

- Visit https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

- Enter PAN, relevant assessment year, and captcha image and click on ‘submit

- Refund status will be displayed on the next screen

- Refund paid details will also be reflected in Form 26AS in the ‘Tax credit statement’

7. Key points to be noted in case of refund claim

- If the online refund status says- ‘refund had expired’, kindly request for re-issuance of refund by either logging into the e-filing portal or by contacting your assessing officer in case the return was filed manually.

- If the Status says – ‘refund had returned’- this could be due to the cheque or demand draft sent to specified communication address has returned undelivered or the bank account details provided for ECS are incorrect. In such cases, contact your assessing officer to get the refund re-issued with the right details. In the case of e-filing, place a request for the re-issuance of a refund in your e-filing account.

- If the status says – ‘refund paid’- this could be a delay from processing the bank’s end. Check with the concerned department of refund banker i.e., SBI

- If the status says – ‘no demand no refund’, this could mean that return is processed, but the income tax department has found that there was no refund payable. In such cases, you can file for rectification by submitting all the relevant income and investment proofs.

- Additionally, it is important for a taxpayer to intimate the income tax department if the details of the bank account quoted in the income tax return for receipt of the refund is closed before receiving the refund or there has been a change of address.

8.Procedure for a request for re-issue of refund

- Login into the income tax efiling portal

- Under ‘My Account’ click on “Refund Re-issue Request”

- Enter PAN, relevant Assessment Year, CPC Communication Reference Number if any, Refund Sequence Number (available on the intimation sent by CPC) and Click on the ‘Validate’ button.

- After validation, the taxpayer can select the mode of Refund Reissue i.e., ECS or paper mode

- The Taxpayer can choose to update the Bank Account Details from the option under the field ‘Do you want to update Bank Account details?

- If the taxpayer selects ‘Yes’, he has to enter details in the additional fields i.e. Bank Account number, Type of Account, and IFSC code

- If the taxpayer has chosen the paper mode of refund, he can choose the address to which the cheque has to be sent under the dropdown ‘Category’.

- If the taxpayer selects ‘ITR Address’, the address provided in the ITR uploaded will be used

- If the taxpayer selects ‘PAN Address’, the address provided in the PAN will be used

- If the taxpayer selects ‘New Address’, the taxpayer has to enter details in the additional fields displayed.

- Click on ‘Submit’ to validate the details.

- On successful validation, the taxpayer will get the success message.

Though all efforts have been made to ensure the accuracy and currency of the above article, the same should not be construed as a statement of law or used for any legal purposes or any litigation as legal and binding advice from Team KabraVaibhav. Team KabraVaibhav hereby expressly disowns and repudiates any claims or liabilities (including but not limited to any third-party claim or liability, of any nature, whatsoever) in relation to the accuracy, completeness, and usefulness of any information available through this article, and against any intended purposes (of any kind whatsoever) by the use thereof, by the user (whether used by user(s) directly or indirectly).

THIS ARTICLE IS FOR INFORMATION PURPOSE ONLY